Nvidia AI stock has captured the attention of investors worldwide, as the company has consistently demonstrated its position as a trailblazer in the realm of artificial intelligence (AI) innovation. With a market capitalization surpassing $500 billion, Nvidia AI stock has become a popular choice among investors seeking exposure to the rapid growth of AI technology. As an investor, gaining a deep understanding of Nvidia’s AI roadmap is essential for making well-informed decisions about the company’s future growth prospects and determining whether Nvidia AI stock aligns with your investment goals and risk tolerance.

In this comprehensive article, we will take a close look at the key features of Nvidia’s AI strategy, which has propelled the company to the forefront of the AI revolution. From their cutting-edge GPU hardware and software platforms to their collaborations with leading research institutions and industry partners, Nvidia has established itself as a driving force behind the advancement of AI technology. We will share our firsthand experience with Nvidia’s products, providing valuable insights into their performance, ease of use, and potential applications across various industries.

Furthermore, we will delve into the pros and cons of adding Nvidia AI stock to your investment portfolio. While the company’s strong financial performance, market leadership, and promising growth prospects make Nvidia AI stock an attractive option for many investors, it is crucial to consider the potential risks and challenges that come with investing in a rapidly evolving and highly competitive industry. By weighing these factors carefully, investors can make well-informed decisions about whether Nvidia AI stock is a suitable fit for their long-term investment strategy.

We strongly recommend that you check out our guide on how to take advantage of AI in today’s passive income economy.

Table of Contents

Key Features

- Cutting-edge AI hardware: Nvidia’s GPUs and AI-specific chips, such as the Tensor Core GPUs, offer unparalleled performance for AI workloads.

- Comprehensive AI software stack: Nvidia provides a robust suite of AI software, including frameworks, libraries, and tools, to accelerate AI development and deployment.

- Collaboration with industry leaders: Nvidia partners with major tech companies and research institutions to drive AI innovation across various sectors.

- Focus on AI research: Nvidia invests heavily in AI research, pushing the boundaries of what’s possible with AI technology.

- Diverse AI applications: Nvidia’s AI technology spans across industries, including healthcare, automotive, gaming, and more.

My Experience

As an investor and technology enthusiast, I have closely followed Nvidia’s AI journey. I have been impressed by the company’s consistent delivery of groundbreaking AI solutions. Nvidia’s AI-powered GPUs have become the go-to choice for researchers, data scientists, and developers working on cutting-edge AI projects.

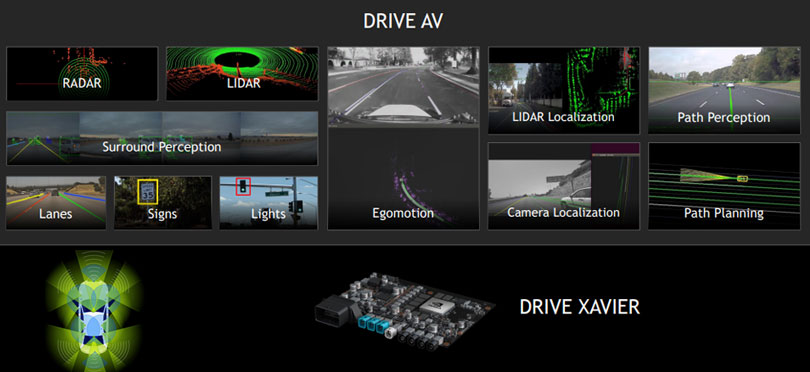

One notable example of Nvidia’s AI prowess is their work in the field of autonomous vehicles. Nvidia’s DRIVE platform, powered by their AI technology, has been adopted by leading automakers worldwide. The platform enables vehicles to perceive, understand, and navigate their environment, paving the way for safer and more efficient transportation.

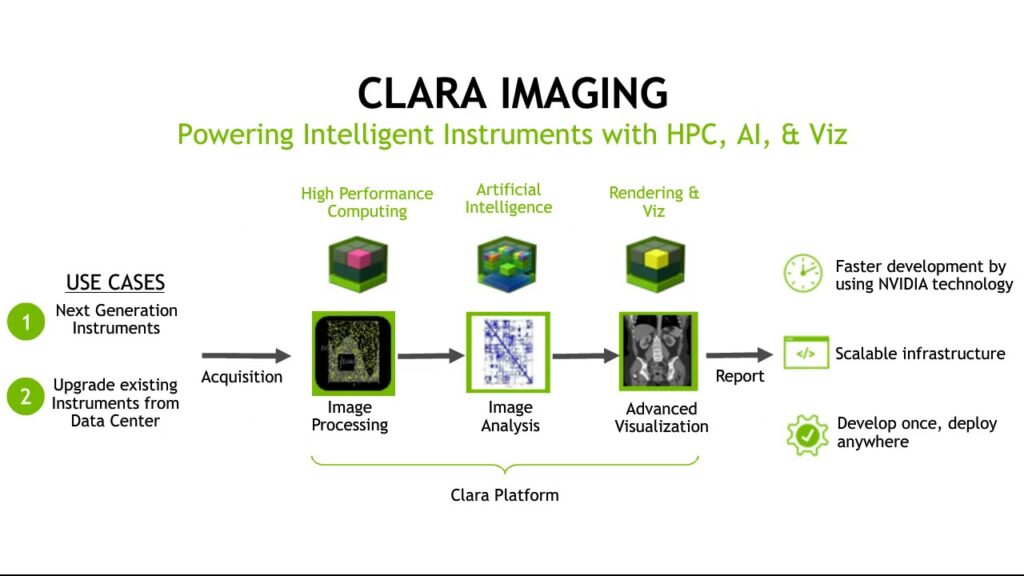

Another area where Nvidia’s AI expertise shines is in healthcare. The company’s Clara platform leverages AI to revolutionize medical imaging, drug discovery, and patient care. By collaborating with healthcare providers and researchers, Nvidia is helping to accelerate the development of life-saving treatments and improve patient outcomes.

Nvidia’s AI technology also plays a significant role in the gaming industry. Their AI-powered GPUs enhance gaming experiences by enabling realistic graphics, intelligent game characters, and immersive virtual worlds. As the demand for more sophisticated gaming experiences grows, Nvidia’s AI innovations position them well to capitalize on this trend.

From a financial perspective, Nvidia’s AI business has been a key driver of the company’s growth. In recent years, Nvidia has consistently reported strong revenue and earnings growth, largely attributed to the success of their AI products. As the adoption of AI continues to accelerate across industries, Nvidia’s AI stock presents a compelling investment opportunity.

Pros

- Strong market position in AI hardware and software

- Diverse range of AI applications across multiple industries

- Consistent financial performance driven by AI business

- Partnerships with leading companies and research institutions

- Robust AI research and development efforts

Cons

- Intense competition in the AI market

- Dependence on the growth and adoption of AI technology

- Potential regulatory challenges related to AI development and deployment

Pricing

As of [current date], Nvidia AI stock (NASDAQ: NVDA) is trading at [current price]. Investors can purchase Nvidia stock through various brokerage platforms. It is essential to consider your investment goals, risk tolerance, and financial situation before making any investment decisions.

Alternatives

While Nvidia is a leading player in the AI market, there are other companies that investors may consider:

- Advanced Micro Devices (AMD): A competitor in the GPU market with a growing presence in AI.

- Intel Corporation (INTC): Offers AI solutions through its Mobileye subsidiary and AI-focused processors.

- Alphabet Inc. (GOOGL): Google’s parent company is heavily invested in AI research and development.

Bottomline

Nvidia AI stock presents a compelling case for investors seeking to capitalize on the tremendous growth potential of artificial intelligence. The company’s well-defined AI roadmap, which encompasses cutting-edge hardware, a comprehensive software stack, and a wide range of applications across multiple industries, positions Nvidia as a dominant force in the AI market. Nvidia’s AI stock has consistently demonstrated strong performance, driven by the company’s relentless focus on innovation and strategic partnerships with industry leaders.

While there are inherent risks and challenges to consider when investing in Nvidia AI stock, such as intense competition in the rapidly evolving AI landscape and potential regulatory hurdles, the company’s robust financial performance and collaborative approach to AI development help mitigate these concerns. Nvidia’s AI stock has proven to be a resilient and attractive option for investors who have a long-term perspective and are willing to ride the waves of the AI revolution.

As with any investment decision, thorough research and due diligence are paramount before allocating funds to Nvidia AI stock. Investors should carefully assess their risk tolerance, financial goals, and overall investment strategy to determine whether Nvidia AI stock aligns with their portfolio objectives. By staying informed about Nvidia’s AI roadmap, market trends, and competitive landscape, investors can make well-informed decisions and potentially reap the rewards of investing in one of the most promising AI companies in the world.

Frequently Asked Questions

Is NVDA an AI stock?

Yes, Nvidia (NVDA) is widely considered an AI stock due to the company’s significant focus on developing hardware and software solutions for artificial intelligence applications. Nvidia’s GPU technology is at the forefront of AI computing, powering deep learning, machine learning, and other AI workloads across various industries, such as autonomous vehicles, healthcare, and gaming.

Is Nvidia the leader in AI?

Nvidia is often regarded as one of the leading companies in the AI industry. The company’s advanced GPU technology, comprehensive AI software stack, and strategic partnerships with major tech companies and research institutions have positioned Nvidia as a key player in the development and deployment of AI solutions. However, it is important to note that the AI market is highly competitive, with other major tech companies like Intel, AMD, and Google also heavily investing in AI research and development.

What’s the best AI stock to buy?

Determining the best AI stock to buy depends on various factors, including your investment goals, risk tolerance, and market outlook. Nvidia is certainly a strong contender, given its market leadership and growth potential in the AI space. However, other companies like Intel, AMD, Alphabet (Google), and Amazon are also making significant strides in AI and could be worth considering. It’s essential to conduct thorough research, analyze financial performance, and consider the competitive landscape before making any investment decisions.

Is it too late to invest in Nvidia?

While Nvidia’s stock price has experienced significant growth in recent years, it’s never too late to invest if you believe in the company’s long-term prospects and its ability to continue innovating in the AI space. However, it’s crucial to keep in mind that past performance does not guarantee future results, and the stock market can be volatile. Before investing in Nvidia or any other stock, it’s important to assess your financial situation, investment timeline, and risk tolerance. Additionally, consider diversifying your portfolio to manage risk and consult with a financial advisor to help guide your investment decisions.

What is Nvidia’s primary focus in the AI market?

Nvidia’s primary focus in the AI market is developing cutting-edge hardware and software solutions that enable faster, more efficient, and more accurate AI processing. Their products are used across various industries, including autonomous vehicles, healthcare, gaming, and more.

How has Nvidia’s AI business impacted its financial performance?

Nvidia’s AI business has been a significant driver of the company’s financial growth in recent years. The increasing adoption of AI technology across industries has led to strong demand for Nvidia’s AI products, resulting in consistent revenue and earnings growth.

What are some of the key risks associated with investing in Nvidia AI stock?

Some of the key risks associated with investing in Nvidia AI stock include intense competition in the AI market, dependence on the growth and adoption of AI technology, and potential regulatory challenges related to AI development and deployment. It is essential for investors to carefully consider these risks before making investment decisions.

We strongly recommend that you check out our guide on how to take advantage of AI in today’s passive income economy.